Mortgage Rates Fell Below 3% in July 2020

Mortgage Rates Fell Below 3% in July 2020

The average US rate for a 30 year fixed mortgage rates fell below 3% in July 2020. This is the first time in the almost 50 years it’s been being tracked. WOW! The average 15 year fixed rate also fell into the mid 2% level. Another WOW! Now is definitely the time to buy a home if you want to get the most bang for your buck!

What does this Mean to You?

Let’s look at some hard numbers. If you bought a home for $200,000 on a 30 year fixed rate of 4%, which is still low in modern times, your payment with principal and interest would be about $951.

For the same home at a rate of 2.9%, your payment would be $830. That’s a $121 savings per month and a $44,000 savings over the life of the loan!

If you are comfortable with the $951 per month, you could get a lot more house than you thought you could!

For instance, in 2019, the average mortgage rate was 3.9% for the year. Let’s say you qualified for a home mortgage of $275,000.

If the rates today are 2.9%, you could now qualify for a home priced at $311,000. That’s a $36,000 increase in your buying power just because of a lower mortgage rate.

Other Considerations

Although the mortgage rate is not the only factor in one’s monthly mortgage payment, it pays a significant roll in how much that monthly payment will be.

Things like property taxes and homeowners insurance also play a role in the final monthly payment amount. However, when the mortgage rates fell below 3%, clients should see a significant savings on their 15 year and 30 year mortgage payments.

Rent vs Buy

Actually, with rates this low, it could very well be cheaper for you to buy a home and build equity than to pay rent. Renters should definitely be talking to their lenders and seeing if they qualify or what they need to do to qualify.

Don’t let these record low interest rates pass you by!

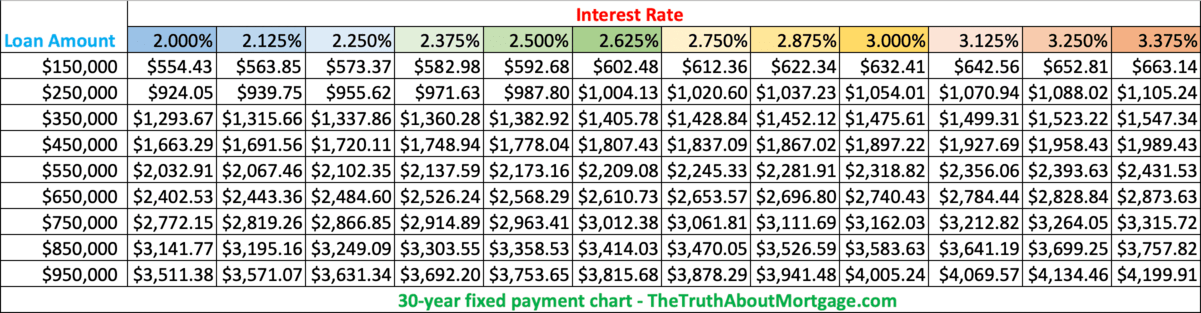

Monthly Mortgage Payment Chart

Below is an awewsome mortgage rate chart provided by thetruthaboutmortgage.com website. It shows you the different rates and what your monthly payment would be. You can figure out what your buying power is buy checking the monthly payment your lender approves you for.

Now is the Time to Buy

Now do you see why we say now is the time to buy your first or next home? Remember, 40 years ago, interest rates were at their historic highs in 1981 – 16.63%. Glad I didn’t own a house back then!

Bottom line is, talk to your lender or we can help you find the one who is right for you! Dust off your shoes and let’s find you a new home!